Two major trends are driving retail analytics these days: “Big Data” and how to handle it on the one hand; and atomic data needs, the real-time sense-and-respond analytics that need to be delivered in bite-sized chunks, on the other. In effect, retailers need to manage and understand macro- and micro-impacts simultaneously. Throw in new data sources like social media and explosive growth in mobile devices that make it easier to access analytics in new form factors, and you’ve got a mess. Retailers just aren’t that familiar with social media and mobile, and honestly have no idea how to apply the resulting analytics to business decisions. What does it mean if one product gets 25 percent more Facebook “likes” than another in its category, if anything?

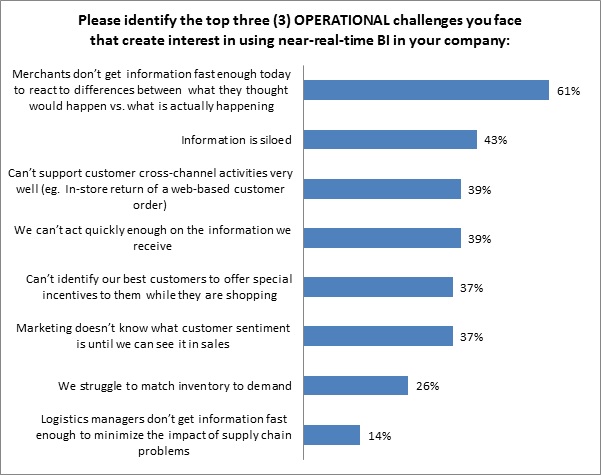

With all of these desires to manage micro- and macro-data simultaneously, retailers in RSR Research‘s just-released Business Intelligence benchmark are in fairly strong consensus about the operational challenges they face: merchants simply can’t get information fast enough to react to the differences in what they thought might be happening vs. what actually is happening. In fact, this top challenge has escalated in importance even in the past 12 months (52 percent in 2011 vs. 61 percent in 2012, Figure 1).

Figure 1: Time to Get Creative

Source: RSR Research, October 2012

This year, RSR Research offered retailers a new option. The goal was to learn if the siloed nature of the way a modern retailer is set up (merchandising over here, marketing over there) was plaguing its ability to share and act upon potentially valuable information. As the second most popular selection, the answer was clear: 43 percent of retailers said that their attempts to utilize data across the various departments they had set up to “divide and conquer” the workload presented a significant operational challenge. It only makes sense that larger retailers feel this pain even more (55 percent for those with sales of $1 to $5 billion and 47 percent for those above $5 billion). As operations scale and departments become less entwined, so too does the human nature of employees to keep to themselves. It is a problem only a handful of headline worthy, organizationally innovative companies have found solutions to so far.

A Time for Reconciliation

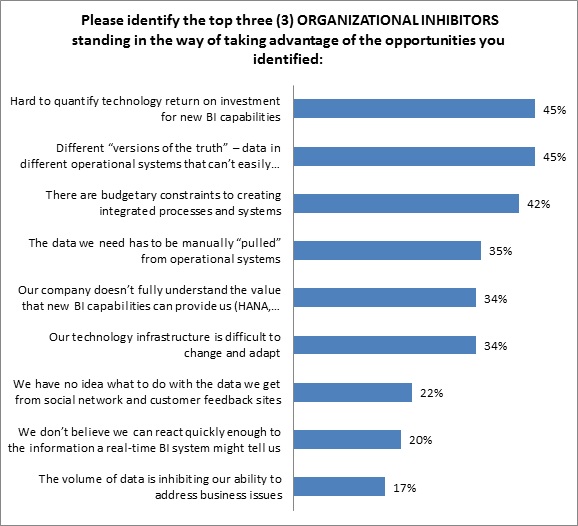

As always, budgetary constraints and return-on-investment (ROI) proof-of-concept show up as retailers’ top inhibitors to new processes and systems. However, the difficulty in reconciling different versions of the truth from one operational system to another is becoming even more prevalent as time marches on (42 percent, Figure 2, up from 34 percent in 2011). This compounds the issues retailers reported in the previous chart: not only do their different internal departments have trouble sharing information with one another, but the various systems they use in their day-to-day operations would render it difficult even if the culture to do so was in place.

Figure 2: Hurdles to Conquer

Source: RSR Research, October 2012

Winners, no doubt further along in their efforts to modernize and replace these systems, report varying points of frustration:

- 44 percent of Retail Winners are inhibited by their existing need to manually pull data from operational systems while only 17 percent of laggards identify this as a problem.

- 40 percent of Winners (vs. 30 percent of average and 17 percent of lagging retailers) say they don’t fully understand the value new Business Intelligence (BI) systems, such as HANA, Hadoop or Exadata, can bring to their IT efforts. This is an indicator that the best performers are further along in examining next-gen BI solutions. Laggards haven’t even gotten around to examining these new technologies.

- 40 percent of Winners say their technology infrastructure may be difficult to change and adapt while only 25 percent of laggards report the same problem.

Put simply, Winners are “further down the rabbit hole” in bringing their BI systems up to date. Laggards don’t yet know what tactical challenges await. The full report, Business Intelligence: A Work in Progress, examines many more of the challenges and opportunities that retailers perceive right now.