by Vladimir Kuchkanov

by Vladimir Kuchkanov

It seems that COVID-19 related news is fading away. Even though according to WHO, it is too early to relax restrictions, a number of European countries, including Spain, Italy, Greece, and Austria, are planning to open their borders for tourism in the next few weeks. Even the New York Stock Exchange (NYSE) is going to open its doors after a two-month break. This is definitely good news for retailers since it seems the market is starting to recover.

However, there is one “but.” Not all companies have survived the sudden economic downturn sparked by the Covid-19 pandemic. Take Neiman Marcus and JCPenney long established retailers, both of them declared bankruptcy in May.

What were the reasons behind it? Of course, we cannot ignore the impact of economic trends or wrong marketing decisions made in the past, but one reason could have played a key role. While quarantine measures might be easing down, customer behavior has definitely changed irrevocably. This can particularly be seen in matters concerning the purchase process.

In one of its posts, Weforum discussed how the COVID-19 pandemic is fuelling the growth of the stay-at-home economy. At the same time, as The BrandZ Top 75 Most Valuable Global Retail Brands 2020 report emphasizes, businesses that are taking action to make a difference in the lives of people confined to their homes and forced to change their habits will become top dogs in their markets. Moreover, today’s winners have to be seen as more than just a friend in a time of crisis; there must be clear relevance to consumers’ lives. Being useful is going to be required even when the world eventually goes back to normal.

The simplest way forward for any retail brand is to go online. Figures speak for themselves:

- In the US, as many as 29% of surveyed consumers say that they will never go back to shopping in brick and mortar stores again

- In the UK, 89% of buyers say they have reduced or stopped going to the shops due to COVID-19

- 43% of UK respondents state that they expect to keep on shopping the same way even after everything comes back to ‘normal’

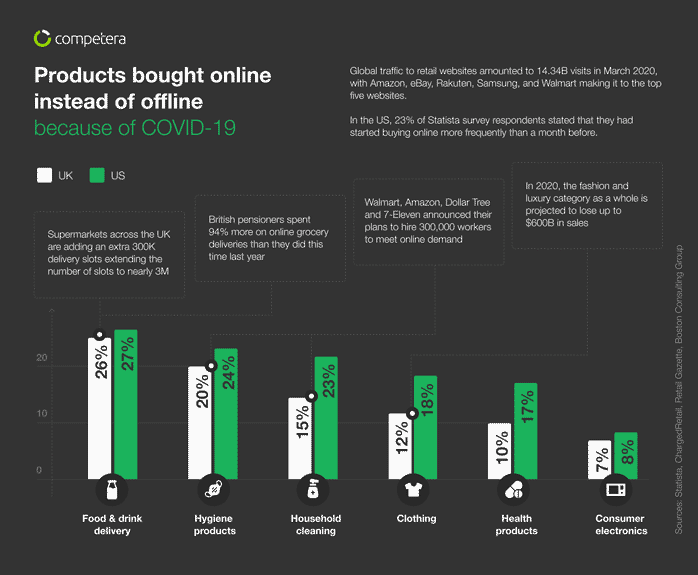

Most surprisingly, this situation affects virtually all retail areas regardless of country or continent. Let’s take a look at the latest infographics from Competera, a company that is directly involved in pricing and strategy development for retailers.

Although these infographics disclose two major markets, the data is indicative. The growth of the ecommerce market is observed in all major retail areas – from 27 percent growth in the US for groceries to 8 percent growth in consumer electronics. The slow-speed growth in the latter case is associated with an established customer behavior pattern of being accustomed to shopping for electronics online. The average growth of ecommerce was 25 percent.

Furthermore, as Competera’s data shows, global traffic to retail websites reached 14.3 billion visits in March — almost twice the size of the Earth population. As you might have guessed, Amazon came in first with a staggering 4 billion users per month.

Another highlight of the infographic is related to social and demographic patterns. Unable to fully compensate for the lost offline sales, ecommerce has integrated into the everyday lives of people of almost all ages and backgrounds. Here are some examples:

- During the lockdown, British pensioners (aged over 65) spent 94% more on online grocery deliveries than they did this time last year

- To meet the growing demand, UK supermarkets announced that the number of delivery slots has increased to nearly 3 million, compared to 2.1 million before the pandemic

- In the US, the unprecedented surge in online demand has forced Walmart, Amazon, Dollar Tree, and 7-Eleven to hire additional 300,000 workers.

On the other hand, we cannot say that such growth can be seen in all categories. According to BigCommerce, such categories as swimming goods, luggage, or cameras were the most negatively affected. Some of them witnessed a drop of up to 77 percent at the start of the lockdown. However, many retailers believe that these categories will win back their positions as soon as customers return to their usual hobbies and feel the need to buy the necessary equipment.

If your business isn’t online yet or you’re just at the beginning of the ecommerce journey, we have some good news. The change in consumer behavior happening right now means that the rules of retail can be rewritten. Right now is the perfect time to test new hypotheses and develop innovative concepts that will satisfy the newly emerged needs of customers.Vladimir Kuchkanov is a Product Manager at Competera, a company that helps to optimize price formation and increase profit of large retail firms using machine learning and artificial intelligence. Earlier, he focused on analytics at such FMCG companies as Mars and Philip Morris, and was a part of the European committee on price formation at Mars, Inc. Besides, Mr. Kuchkanov gives a Brand Management course at Kyiv Academy of Media Arts.