Last year, the Supreme Court issued a landmark ruling that changed online tax law. The original law predated the internet and was more reflective of mail-order catalogs. Previously, retailers only needed to collect and remit sales tax if they had a physical presence in that state. On June 21st, 2018, the Supreme Court ruled that ecommerce retailers will have to comply with the sales tax laws of individual states regardless of whether or not they have a physical presence.

Last year, the Supreme Court issued a landmark ruling that changed online tax law. The original law predated the internet and was more reflective of mail-order catalogs. Previously, retailers only needed to collect and remit sales tax if they had a physical presence in that state. On June 21st, 2018, the Supreme Court ruled that ecommerce retailers will have to comply with the sales tax laws of individual states regardless of whether or not they have a physical presence.

This change may be at the top of your mind as we’re currently in the throes of tax season. While many states and brick and mortar retailers celebrated this decision, it certainly complicates things for small online sellers. If you’re a larger online retailer that sells across state borders, hopefully you collected sales tax over the holiday season. While some states just put their laws into effect this year, some went into effect in 2018, which means if you meet the designated criteria you will need to pay taxes.

Stephen Yarbrough, CPA and VP of Tax at Kruze Consulting and former IRS Senior Revenue Agent says that overall, the new ruling creates more complexity for smaller businesses selling online. There are over 15,000 state and local taxing jurisdictions in the US. He continues that companies with sales over certain dollar and/or transaction thresholds in 13 states (SD, GA, IN, TN, WY, CO, AL, MA, HI, KY, ND, MA, VT) will be impacted, and it’s likely that most states with sales taxes will pass similar tax laws soon.

Stephen has three pieces of advice for online sellers:

- Don’t Panic. The court ruling specifically pointed out that it agreed with South Dakota’s sales tax thresholds because (1) it wasn’t retroactive to past sales and (2) is only applicable when annualized sales into the state exceed $100,000 or 200 transactions per year. So, your initial sales into states where you don’t have a physical presence will remain tax-free, until you hit each jurisdictions’ thresholds. And while the case will ultimately apply to most states, it’s likely that there will be a transition period as they adapt to the ruling.

- Software Can Help. Get set up with a 3rd party multi-state sales-tax collection/filing service. Companies like Avalara, TaxJar or TaxCloud are off the shelf solutions that would help small businesses. TaxCloud even has a free product that will likely work for the smallest companies with sales of simple, tangible products.

- Get a Multi-State Sales & Use Tax Study. This will help to determine in which states your product would be taxable. Note that it’s not just e-commerce that is impacted by sales tax – other online services may be taxed as well, depending on the local tax laws. I’d recommend that companies with serious revenue in multiple states get a Multi-State Sales & Use Tax Study.

When finalizing your taxes this year, there are a few other things that all retailers should keep in mind. This is the first tax season that is impacted by the Tax Cuts and Jobs Act of 2017. Under this act, the corporate tax rate dropped from 35% to 21%. However, most small businesses, including retailers, aren’t corporations but LLCs or sole proprietors. This classification means that small business owners pay taxes for their business through their personal tax returns.

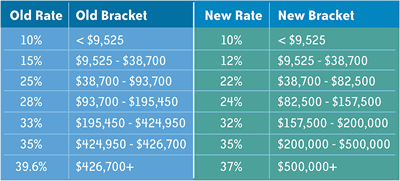

Personal tax brackets are different now under the new tax law then they were during last year’s tax filing. Overall, many individuals will pay a slightly lower rate. But, there are a few income levels in the middle that will pay slightly more.

The deductions also changed this year. The new legislation limits state and local tax deductions to $10,000. This means that people living in areas with high state tax, such as New York or California, may not get as large of a break on Federal taxes.

Under the new tax law, the standard deduction has drastically increased from $6,350 for single filers and $12,700 for joint filers to $12,000 for single filers and $24,000 to joint filers. Since the standard deduction has increased, the itemized deduction threshold also increased. The general idea behind this is to encourage more tax filers to use the standard deductions. However, especially since this is the first tax return season under the new law, we encourage all individuals and businesses to consult with an accountant or at least a tax software program and calculate both standard and itemized deductions to ensure the maximum return.

There is no need to panic, but you always want to make sure you are setting yourself and your business up for success. An unexpected tax bill is enough to throw anyone for a loop. Consider hiring an accountant or tax professional if you do not have one. If you sell online, invest in a software that automatically calculates and collects the appropriate sales tax.