by Steve Rowen

What happened in 2007 rocked the retail world. Consumers started using their new smart mobile devices to find the best solutions for their lifestyle needs. What was “best” was defined by the need, whether most convenient, lowest cost, unique, or any combination. No longer confined to the physical four walls of the store, consumers could access a whole world of possibilities. Even if consumers intended to ultimately shop in a store, they could look via the Web for the best products, reading reviews, getting input from others via social networks, reading product information, comparing, and finding the best price and availability for the chosen solution. “Omni-Channel retailing” was born.

What happened in 2007 rocked the retail world. Consumers started using their new smart mobile devices to find the best solutions for their lifestyle needs. What was “best” was defined by the need, whether most convenient, lowest cost, unique, or any combination. No longer confined to the physical four walls of the store, consumers could access a whole world of possibilities. Even if consumers intended to ultimately shop in a store, they could look via the Web for the best products, reading reviews, getting input from others via social networks, reading product information, comparing, and finding the best price and availability for the chosen solution. “Omni-Channel retailing” was born.

In the newest report released by Retail Systems Research, the company sought to answer the question: Are retailers and consumers aligned? What is the value of mobile technologies as a component of the shopping experience?

Retailers now accept that consumers use mobile devices before and during the shopping experience, even while roaming through the store. While showrooming is still a concern for retailers, it’s rare nowadays to hear a retailer talk of “wrapping the store in tin foil” to disable cellular or wide area access to the Web. Instead, many retailers are trying to make it easier for consumers to use their wifi services, so that they can engage in an active dialogue with consumers while they browse in the digital space, or, more likely, observe what consumers are doing in the digital space as a way to gauge demand.

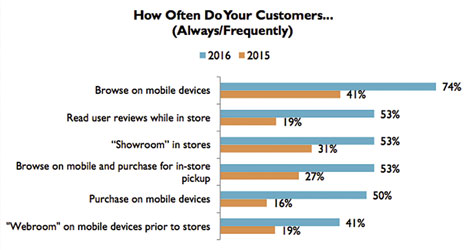

In just one year, from 2015 to 2016, figure 1, below, shows how much retailers’ acceptance of consumer mobile behaviors has grown.

There is now very little dissention that consumers use smart mobile devices to browse for the right products and services. A majority of retailers who responded to our survey believe that consumers are using mobile to access valuable content before and during their visits to the store. While showrooming is still a concern, “click & collect” is now perceived to be just as likely to occur.

Clearly, hard-goods merchants, which include consumer electronics retailers, are most aware that consumers are using their mobile devices both in and before going to the store, and they are most concerned that consumers will engage in showrooming. The only real surprise in how retailers view consumer mobile shopping activities is that the majority of fashion merchants don’t believe that consumers use their mobile devices while in the store, perhaps assuming that the visual appeal of their products is more important than content about those products.

While these differences are interesting, the bottom line is that retailers know that consumers use mobile at least to browse for products, and probably to do much more than that. While for the vast majority of retailers, stores may still record the sales, the digital channel – accelerated by consumer mobile technologies – enables those sales.

The Winners’ Story: Digital Channels Converge

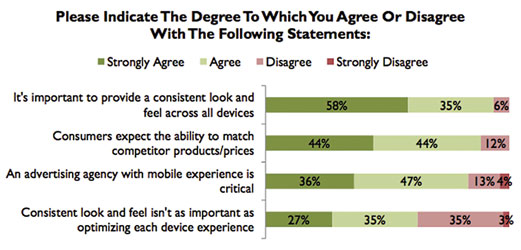

In RSR’s February 2016 E-Commerce benchmark study, Digital Divergence: The Future of Digital Commerce, we observed that “digital convergence has not yet been achieved – it takes only a stroll through a retailer’s online touch-points to see how disconnected their digital strategy really is. However the intent is clearly there….” We see further evidence that retailers concur that a “consistent look and feel” is critical to success.

As we saw with retailers’ attitudes about consumer uses of mobile, we find a growing awareness of the importance of a consistent look and feel; in 2015, 46% of retailers “strongly agreed” that consistency across any device was important, whereas now a strong majority (58%) feel that way. The notion of consistency across digital platforms is important because it implies that retailers are no longer thinking of mobile as separate from the entire digital offering – thus convergence.

But looking inside the responses, we see that this is primarily a Winners’ story. Seventy-three percent of over-performing retailers, versus 48% of all other respondents, believe that a consistent look and feel is critical to success. As we usually find in virtually every benchmark study we conduct, over-performers – Retail Winners – don’t merely do the same things better, they tend to do different things. They think differently. They plan  differently. They respond differently. When it comes to mobile, it turns out that Winners have been much more aggressive in trying “everything” before settling on what’s best when it comes to a mobile offering.

differently. They respond differently. When it comes to mobile, it turns out that Winners have been much more aggressive in trying “everything” before settling on what’s best when it comes to a mobile offering.

As the report has confirmed, the jury is still out regarding whether the mobile offering requires a specialized platform, a downloadable consumer app, or an E-Commerce platform that is responsive to the device that accesses it is the right approach. The majority of Winners are trying them all. This is indicative of two things; first that Winners are more comfortable with experimentation than their less successful competitors, and second, it’s still early days when it comes to mobilizing the selling environment.

But retailers in all performance groups know they need to hurry up – consumer expectations are high and tolerance for inconsistency is low. “Easier to use than to ignore” is a key to winning consumer loyalty in today’s retail environment.

The Small Retailers’ Dilemma

According to survey responses, smaller retailers are feeling the most pain when it comes to consumer mobile offerings. To put it bluntly, they feel more than any other subset of our overall response group that they have to catch up to consumer expectations for mobile, but also are a lot less clear about what exactly consumers wants from a mobile presence.

The differences between the very largest retailers (>$5B in annual revenues) and smaller retailers (< $250M) are glaring. While the largest retailers express their greatest concern about “consumer privacy concerns over how retailers collect or use data”, their small retail peers don’t even get there. Instead small retailers’ top concern is that “consumers expect to use mobile as part of their shopping experience and we need to be there.” The reason for this difference may simply be because large retailers already have mobile solutions in place, and smaller retailers don’t.

What reinforces that line of thinking is another difference in the responses: while over half of the largest retailers express a concern that “we’re seeing significant online traffic from mobile sources and need to respond”, only 1?3 of smaller retailers worry about that, while twice as many smaller retailers are concerned that “we don’t know what the customer perceives as valuable in a mobile offering” compared to the largest retailers.

The inference is pretty clear – the larger the retailer, the more likely it is to have something in place that is already delivering a “digital” experience, whether or not the retailer or the consumer is happy with it. Small retailers are just in a whole different place – they know they need to do something, but they don’t know what it is or how they can afford it.

Small Retailers: Get Moving

The smallest retailers are currently faced with a tremendous opportunity – by leveraging their nimble nature, and because they consistently operate fewer stores than large chains, small retailers stand to fold more mobile solutions into the entire shopping experience than their larger competitors.

For their employees, this means an opportunity to become more relevant to in-store shoppers, who have long outgunned them technologically. Also within stores, it means an opportunity to provide more customer-facing benefits leveraging the devices consumers already own and love. In sum, it means the opportunity to make stores more interesting places to shop. However, as shown in this research, small retailers seem to be missing their window of opportunity; too scared to go out on an adventurous limb. The time to execute – or at least pilot – bold new ideas is NOW.