The overarching theme of retail consumers in 2019 is high expectations. Higher consumer confidence, higher wages, innovative startups and emerging technology all contribute to unrelentingly high standards. But, for all of those same reasons small businesses are in a better position now, more than ever, to exceed consumers’ high expectations.

Here’s a deeper dive into the major factors impacting our economy and consumer confidence in 2019:

Low Unemployment

At the end of 2018, the U.S economy held low unemployment rates of just 3.7%, the lowest rate in 50 years. In the first few months of 2019, the unemployment rate has hovered around 4%. It is true that a good number of employed people are working just part-time, or looking for higher paying work, But, overall this low unemployment rate is a great economic indicator and certainly hints that consumer spending will continue at a healthy level this year.

While this is good news for our economy and for consumer spending, low unemployment is a sort of double-edged sword for retailers. It means that retailers, which typically offer hourly pay around minimum wage with sometimes unpredictable hours, have had a hard time finding and retaining employees, especially seasonal employees. Retailers across the country are rethinking their benefits packages and company cultures to attract more workers.

High Wages

Low unemployment rates also lead to overall higher wages. At the moment, it’s a buyer’s market and employees have a little more power to negotiate better deals for themselves, as fewer and fewer people are actively seeking work. These higher wages of course lead to higher consumer confidence, and a greater ability to spend and invest in local economies.

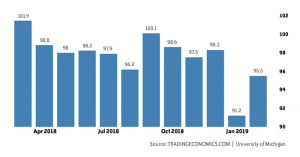

High Consumer Confidence

At the end of 2018, consumer confidence was at a 20-year high. In January, that number tumbled as a result of the government shutdown. But, consumer sentiment is bouncing back. Barring any additional government shutdowns or similar crises, consumer confidence is on track to return to healthy high levels. And, if we look at the biggest picture, despite the dip in January, overall consumer confidence has been steadily increasing over the past ten years.

Possible Recession on the Horizon

Despite high wages, low unemployment, and overall high consumers confidence, some experts predict a recession on the horizon. Elements like trade uncertainty factor into the reality that all good things come to an end, and unfortunately, the positive economic growth we’ve experienced over the past two years is no exception. Our economy is cyclical, and many economists and analysts are preparing for the next recession. The next recession is not predicted to hit in the immediate future, but possibly in 2020. To put it in perspective, the United States has had 12 recessions since World War II. It’s been 10 years since the last recession hit, so it’s worth starting to prepare now while our economy is doing well, for what is inevitably down the road.

To prepare, Deloitte released a new study entitled “The next consumer recession: Preparing now.” It examines the two most recent recessions, the Dot.com bust and the Great Recession, to see what led up to each, how they impacted the consumer economy and how the next one might impact consumer businesses, most especially retailers.

Bottom Line

Jay Sole, executive director of UBS Securities LLC said at the National Retail Federation’s BIG Show in January that 70% of our economy is driven by consumer spending. Consumer spending comes down to two things: shoppers ability to spend and willingness to spend. Right now, shoppers ability and willingness to spend are generally high and in good shape.

Jack Kleinhenz, Ph.D. the chief economist for NRF says that we will see slower growth in 2019 as stimulus from the new tax law wears off. The tightening of the labor market and consumer sentiment will stay elevated, which means households are in a good place. Additionally, the ratio of debt to disposable income is in a good place. And, we have some tailwinds heading into the year: full employment, high wages, tax benefits spreading through the populace, and gas prices have trended downward. Though it is inevitable that these economic good times won’t last, enjoy them now by making the most of your sales and investing in the growth of your business so that during the next downturn, your business is well prepared.