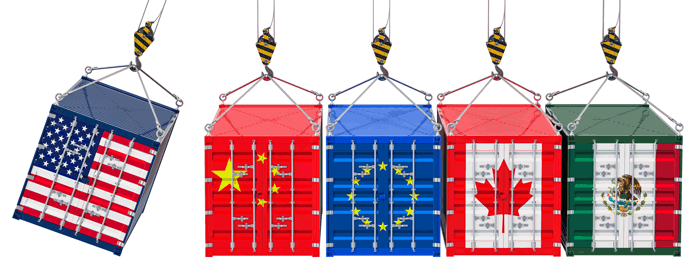

Over the summer, the Trump administration garnered a lot of attention over talks of a “trade war” with China and the prospect of the United States pulling out of NAFTA (the North American Free Trade Agreement). Now that the holiday season is just about here, shoppers and businesses alike are taking a harder look at how tariffs and new trade deals could impact business operations and consumer pricing.

Why Does it Matter?

Tariffs are duties imposed by the government on imported goods. Essentially, they are a tax on imports. Tariffs are collected by Customs and Border Protection agents at 328 ports of entry across the United States. When a retailer or wholesaler purchases goods from overseas, they have to pay the tariff on top of the regular costs of goods. Whoever does the importing is responsible for paying the tariff.

The purpose of the tariffs is to encourage more manufacturing in the United States, and to level the playing field for American-made products and supplies in terms of cost. Tariffs also provide additional revenue for the federal government.

Earlier this year, President Trump imposed a 25 percent tariff on steel and a 10 percent tariff on aluminum imported from most countries including China, the European Union, Canada, and Mexico. Over the summer, President Trump also imposed a 25 percent tariff on 800 categories of goods imported from China worth $50 billion.

In September, 10 percent tariffs on $200 billion Chinese imports including many consumer goods such as apparel and appliances. However, the tariffs will increase to 25 percent starting in January 2019.

In an October press release, NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said, “Retailers are continuing to import merchandise in order to meet consumer demand even though tariffs are now in place on roughly half the goods imported from China and the trade war is still escalating.”

The National Retail Federation launched a campaign called “Tariffs are Bad Economics” and have very vocally criticized all of the new tariffs, saying: “Tariffs are hidden taxes. They raise prices on things Americans buy every day, including American-made products. Tariffs create uncertainty and make it difficult for retail businesses that rely on complicated global supply chains. American families will see higher prices in every retail store and every online merchant — even small mom-and-pop retailers on Main Street.”

Will Tariffs Affect Your Business?

For many retailers, the costs of goods will increase. If you purchase products that are manufactured in China, whether you import directly from a factory or purchase from a wholesaler that sells imported products, expect to see higher prices that cover the cost of the 25 percent tariff. If you purchase products that are Made in the USA, you should still check with your supplier about any changes in cost. Even if the product is made here, if they are using materials from overseas, you will still be paying higher prices.

Tariffs and Holiday Shopping

Since retailers purchase products months ahead of when they are sold, tariffs will not have a large impact on the holiday shopping season. Most retailers have been able to import items before major tariffs went into effect, so consumers won’t see a pricing markup. Only last-minute imports will likely be affected.

Tariffs and Small Business

The good news is, as an independent retailer, you have flexibility in terms of adjusting your supply chain. If any of your sources or product are impacted by the tariffs, start looking for other sources. Better yet, look to stock products from other local small businesses. National retailers that have complex supply chains and even their own factories will not be able to adjust as quickly as a smaller business can.

The bad news is, larger retailers like Walmart can absorb some of the price increases before passing them along to customers. According to the Wall Street Journal “ the strong U.S. economy will allow retailers and their suppliers to absorb much of the initial costs.”

The holiday season is a busy time all around, but waiting to evaluate your supply chain until after the holidays means you could be stuck paying a 25 percent tariff when they go into effect in January. Take the time to come up with a solution now. Order spring and even summer products before the end of the year if you need to import and look for alternative sources for when the 25 percent tariff takes effect in January.